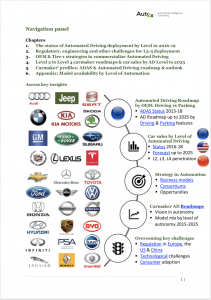

Carmaker Roadmaps to Self-Driving cars 2025

Roadmap to Self-Driving cars 2025

Market Status, forecasts, roadmap & strategy of leading OEMs to commercialise AD

LONDON, UK, November 11, 2019 /EINPresswire.com/ -- When will automated driving tech & regulation converge to allow the first L3 & L4 cars to hit the road? How do leading carmakers plan to commercialize automated driving?

What this report delivers

This report focuses on leading car manufacturers’ ADAS&AD portfolio, strategies and business models to transition towards full automation and self-driving cars.

Moreover, it examines the regulatory landscape and other technical challenges and their implications on deployment of higher level of vehicle autonomy.

Finally, we provide a technological roadmap for the introduction of L2-4 by leading OEM and a penetration forecast of cars equipped with different levels of autonomy until 2025.

Learn about the status of vehicle automation between 2016 and 2019:

- What is the availability of key ADAS features, such as AEB, TSR, ACC, LKA, TJA, in leading

carmakers in Europe, US and China? We provide in-depth segmentation by SAE Level; o What is the penetration rate of SAE Level 0, 1 and 2 in European car sales?

- Which OEMs lead L2 deployment in 2017-19 and why?

- What changes in 2019-20 in terms of deployment of L2 and L3?

Understand the regulatory and engineering challenges carmakers face for the deployment of a higher level of vehicle autonomy:

- What is the status of Autonomous Driving regulation in major car markets?

- What are the differences in the legal and regulatory framework in Europe and the United States and how this will affect L3-5 deployment?

- Which geography presents the most favorable environment for deployment of Level 3?

- What breakthroughs are required in the area of SW/HW and validation for L3-4?

Read how carmakers, Tier-1s and new-entrants, including tech giants Apple and Google (Waymo), plan to overcome the challenges and commercialize autonomous driving

- How do leading OEMs plan to achieve L4/5 capabilities and when?

- OEM strategy, new business models and key collaborations

- Learn why leading Tier-1s are well-positioned to monetize ADAS growth

Who will lead and who will follow in the autonomous vehicle race until 2025?

- Discover when leading carmakers will launch capabilities of L2, L3, L4, and L5 segmented into Driving (L2-TJA vs L3-TJP) and Parking features (e.g. L2-Self Park, L4-Valet Parking)

- What are the trends by ADAS levels in Top Premium OEMs’ model range during 2016-25? o Learn about the penetration of different levels of autonomy in European car sales in 2021

- Benchmark competition: strengths and weaknesses of ADAS&AD product portfolio,

suppliers and competitiveness

1. The status of Autonomous Driving deployment in 2016-17 (21 pages)

SAE Level 2 is already here whereas L3-D will hit the market in 2017

SAE Level 2 status in Europe in 2016: TJA, SP and RP availability in leading OEMs’ model range

L2-D status in Europe in 2016: Traffic Jam Assist (TJA) availability

Comparison of L2-D tech: speeds, lane change, hands-on detection, stop-in lane, and naming strategy

L2-P status in Europe 2016: Self-park and Remote Parking availability

L2 penetration in European car sales in 2016

L2 OEM ranking in 2016 vs 2017: leaders & followers

SAE Level 1 status in Europe in 2016: ACC, AEB CUI, PA and LKA availability in leading OEMs

SAE L0 in Europe: Availability of BSM, DDM, FCW, LDW, TSR in leading OEMs

Marketing names for ADAS L0/1 features in Top-6 Premium OEMs

SAE Level 3 testing pilots: who tests what and where

What does L3-Conditionally automated driving look like?

2. Regulatory, engineering and other challenges for the deployment of L3-L5 (17 pages)

Read why regulation challenges Autonomous Driving deployment

Overview of AD regulatory & legal status in key geographies in 2016

The amendment of Reg.79-Steering equipment will allow L3 deployment in Europe

Today are ADAS are assistive and hands-on the wheel are always required

Reg.79 amendment is the critical step towards self-steering systems

Three concerns arising from the UNECE Reg.79’s amendment

The USA has opened up the road to HAVs with the FAVP

State of AV testing in the United States in 2016/17

Concern over U.S Federal Autonomous Vehicle Policy

L3 automated driving to become legal in Germany from autumn 2017

The impact of AD regulation on L3 deployment

Technical challenges for deployment and other key factors affecting AD adoption

Liability in L3 and the role of Event Data Recorders for AD

Vehicle Cybersecurity becomes a top priority for carmakers

OEM and regulatory activity heats-up in major car markets

What is needed to secure Connected Cars

3. OEM-Tier 1 strategies to commercialize Autonomous Driving (5 pages)

Incremental vs skip approach to reach Highly automated driving

Building your own ADS platform vs collaboration

Learn why leading ADAS Suppliers are well-positioned to monetise ADAS growth

Use cases and business models to commercialize L4/5

4. From Assisted to Autonomous: L2-L5 roadmap from leading OEMs (27 pages)

Overview of L2-L5 Driving and Parking roadmap by OEM at earliest implementation

Trends from the AD roadmap of Top Premium OEMs 2016-2021

Autonomous driving technology deployment: leaders and followers

AD technology roadmap: key ADAS features and sensor set

Partial automation: from single to multi-lane, high-speed systems

The impact of EuroNCAP’s 2025 roadmap

Learn which geographies will lead L3 deployment

L4-Full automation and L5

L4/5-and new mobility concepts

The role of user experience, HMI, smartphones and in-car apps in L4/5

European car sales by level of automation during 2016-2021

Market shares of European car sales by level of automation during 2016-2021

OEM market shares in European car sales by ADAS level 2017 vs 2021

USA

China

5. ADAS&AD portfolio & roadmap by leading OEM (29 pages)

ADAS feature availability in model range in 2016 and sensor set

AD outlook: product roadmap and model range by AD level 2016-2025:

Alfa Romeo

Audi

BAIC

Bentley

BMW

BYD

Cadillac

Changan

FCA

Ford

General Motors

Geely

Genesis

Great Wall

Honda

Hyundai

Infinity

Jaguar Land Rover

Jeep

Lexus

Mercedes-Benz

Maserati

Mini

Nissan

Porsche

PSA

Renault

Renault-Nissan-Mitsubishi Alliance

SAIC

Seat

Skoda

Subaru

Tesla

Toyota

Volvo

VW

Auto2x, Automotive Intelligence & Consulting

Auto2x Ltd

+44 7825 686532

email us here

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.