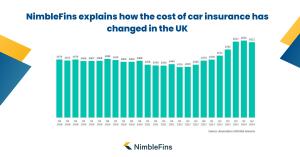

NimbleFins explains how the cost of car insurance has changed in the UK

The car insurance experts at NimbleFins discuss car insurance cost trends in the UK using real-life data, and explain what's behind the big changes.

Erin Yurday, the CEO and Founder of NimbleFins, said: "Motorists are likely to be alarmed at their car insurance renewal price this year. According to NimbleFins analysis of data from the Association of British Insurers, average premiums for comprehensive cover were 27% higher in the first half of 2024 compared to a year earlier, which equates to an extra cost of £134 per year for a typical motorist. The cause of car insurance premium increases is largely down to inflationary pressures impacting the cost of payouts made on claims."

Motor insurance premiums have risen to compensate insurers for increased payouts. Consulting firm EY estimates that for every £1 collected in premiums, the UK motor industry paid out £1.13 in claims and expenses in 2023. Payout figures were higher due to inflationary pressures on insurance payouts like repair costs and car theft compensation.

For example, official RPI statistics from the Office for National Statistics show that motor vehicle maintenance costs, a proxy for repair costs, rose 6.9% from Q2 2023 to Q2 2024 and 8.5% from Q1 2023 to Q1 2024.

And NimbleFins data on the cost of cars shows that many popular models are thousands of pounds more expensive to buy in 2024 compared to 2023, which impacts insurer payouts on stolen cars. For example, the starting OTR price for the Ford Focus rose from £27,080 to £28,490 (an increase of £1,410) from 2023 to 2024 and Nissan Qashqai's starting OTR price rose from £27,120 to £30,135 (an increase of £3,015) over the same period.

NimbleFins tracks costs for typical UK motorists in their research on the cost of car insurance, where they also display how premiums vary by driver age and across different popular vehicles. This information is important so motorists understand what others with similar profiles are paying for car insurance.

Along with this educational information, motorists can compare car insurance quotes on the NimbleFins website as well.

Erin Yurday

NimbleFins Limited

email us here

Visit us on social media:

X

Distribution channels: Automotive Industry, Banking, Finance & Investment Industry, Business & Economy, Insurance Industry, World & Regional

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release